About Drumright Dental Center

Drumright Dental Center has proudly served residents of Oklahoma for over 28 years. The practice is dedicated to providing high-quality dental care to patients and has greatly impacted the community. Family is at the core of their business and a guiding principle, which is also reflected in their progressive approach to continually finding ways to enhance patient experiences.

They adopted a range of payment options, aimed at enhancing accessibility to quality dental services while supporting the practice's growth. However, despite several financing options, they faced challenges. This case study explores how Drumright Dental Center leveraged Denefits to overcome those challenges and the financial barriers, resulting in improved patient care and sustainable growth.

Challenges

As Drumright Dental Center faced the following challenges, they recognized the need for a solution to better serve their patients:

Restricted Control & Flexibility:

Though the practice already had a range of dental financing options, the terms of the third-party providers allowed for limited control and flexibility over the repayment terms.

Credit Check Hurdles:

The credit check requirements stood in the way of those with less-than-ideal credit scores. Many patients struggled due to the rigid terms and slightly low credit scores, which made it difficult to qualify for traditional financing.

High Interest Rates:

Some of the existing financing providers had high interest rates, especially for those with low credit scores, which deterred patients from opting for necessary dental treatments.

Why Drumright Dental Center Partnered with Denefits?

The Drumright Dental Center believes in going the extra mile for patients to ensure that they can accommodate their unique needs. The dental practice had already been using several payment methods, including CareCredit, Sunbit, and Oklahoma SoonerCare. However, most of these either required a hard or soft credit check or had high-interest charges, which wasn’t ideal for every patient. Denefits was able to overcome this with its ‘No Credit Check’ financing solutions.

Reinforcing the core values of the practice, when they discovered Denefits—a payment solution that not only enabled them to offer no credit check financing but also allowed them full control over setting their own terms—they saw it as an opportunity to enhance the value proposition to their patients.

How Did Denefits Help Overturn The Situation?

Alternative to Traditional Financing:

Whenever a patient visited the clinic who could not qualify for conventional financing options, they offered Denefits as a viable option. This allowed more patients to spread the cost of the treatment over time and repay using flexible monthly payment plans that fit their budget perfectly.

Protected Payments:

Denefits’ payment protection feature safeguarded against any missed payments and ensured steady cash flow for the business.

Flexible Financing Options:

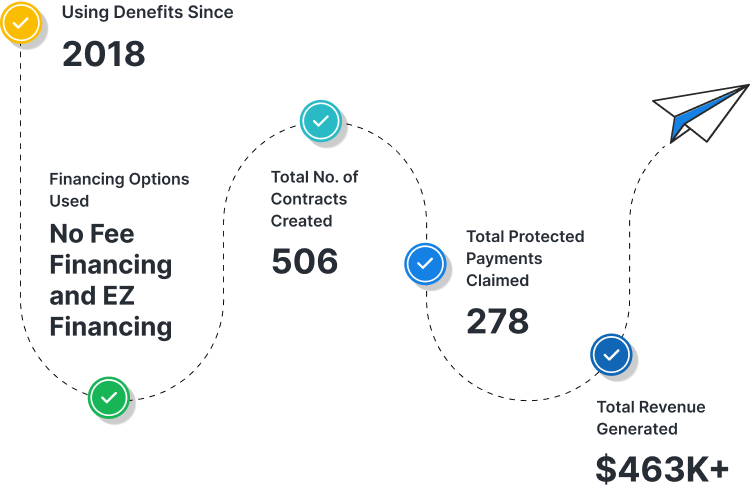

The dental practice utilized Denefits’ “No Fee Financing” and “EZ Financing," which allowed them to meet the financing requirements of different patients with ease. These plans allowed the business to get repayment at the pace that the patients felt comfortable with.

- No Fee Financing: The No Fee Financing allowed the clinic to offer flexibility in payments to patients without incurring any hidden fee or other additional charges.

- EZ Financing: This financing option allowed the patients to enjoy paying interest-free monthly payments during a specified deferred interest period. It also encouraged patients to pay off the full bill within this period to avoid incurring interest charges altogether.

Key Metrics

Results Achieved

38%

Increase in Patient Enrollments: Since partnering with Denefits, Drumright Dental Center has boosted patient enrollments by 38%.

47%

Revenue Growth: The dental practice has steadily increased its revenue over the years by almost half since integrating Denefits.

98%

of Satisfied Patients: Offering additional flexible payment options in addition to dental financing helped boost patient satisfaction rates.

In Their Words

Since we started using Denefits in 2018, we have created over 500 contracts. It has empowered our practice to provide crucial dental services while alleviating the financial strain for more patients than ever. Denefits’ no credit check financing appeals to a large segment of the community across Oklahoma. Thanks to this, our patient enrollments and revenue have increased manyfold. We look forward to continuing this journey of success with Denefits and will continue to uphold our commitment to delivering exceptional patient care.![]()

— Drumright Dental Center

Conclusion

Denefits payment solution helped make dental services more accessible, allowing more patients to receive necessary treatments. The clinic was able to cater to even those patients they would otherwise have to turn away when traditional financing options fall short. Hence, the practice significantly boosted revenue generation over the years, contributing to its sustainable growth.

Discover How Denefits Can Help Transform Your Practice!

Ready to enhance accessibility to quality care and optimize your payment processes? Sign up for Denefits and join Drumright Dental Center and 10,000+ businesses working towards breaking the financial barriers.

Explore how our flexible payment solutions can elevate your practice's success.