It is rare for anyone not to have dental concerns, but it is quite common for people to be unable to afford treatment options.

According to a survey by the CareQuest Institute, 57% of those who experienced an oral health issue in 2023 did not seek treatment, with 25% citing affordability as the primary reason.

The high cost of dental treatments often forces patients to reconsider their options. Even when insurance coverage is available, many find themselves paying out of pocket. Therefore the total expense of the dental treatment becomes a decisive factor in whether they proceed with treatment.

This financial constraint also affects dental practices, as the ability to serve patients is directly tied to their willingness to pay for services. Consequently, practices may have to turn away patients who cannot afford the necessary care.

Dental payment plans offer a solution by bridging this gap. These plans allow patients to spread the cost of treatment over several months or even years, reducing the burden on their wallets. For dental practices, offering payment plans enables them to serve a broader range of patients, including those who might have been previously denied services, ensuring a steady stream of revenue.

Besides this Dental Payment Plans have multiple other benefits. In this blog, we'll explore how these plans work and why they are an effective solution for patients and dental practices.

What Are Payment Plans?

Dental payment plans are financial arrangements that allow patients to pay for their dental treatments over time rather than upfront. These plans can be offered directly by dental practices or through third-party dental financing companies. Payment plans often come with flexible terms, allowing patients to choose a schedule that fits their budget.

How Do Dental Payment Plans Work?

To understand how dental payment plans work, let’s consider an example. Suppose Emma needs dental implants, which typically cost between $1,000 and $3,000 per implant without insurance. Unfortunately, Emma has a low credit score, making her ineligible for traditional dental financing options like medical credit cards or personal loans.

As a single mom living paycheck to paycheck, she has limited savings and cannot afford the $2,000 treatment upfront, even though the persistent pain makes it increasingly difficult for her to carry on. Like 68.5 million American adults Emma does not have dental insurance.

Instead of paying the $2,000 upfront, Emma can opt for a payment plan. With this plan, she might pay $100 per month over 20 months, allowing her to gradually cover the cost of her treatment without the stress of a large, immediate expense. This flexible option not only makes the treatment affordable for Emma but also relieves her from enduring ongoing discomfort.

How Do Dentists Get Paid?

The Dental Practice Perspective

From the perspective of dental practices, offering payment plans can make a significant difference. Without such options, practices might have to deny services to patients like Emma who are unable to pay for their treatments upfront and lack dental insurance. As more patients face financial constraints, practices risk losing a substantial portion of potential customers who simply cannot afford the high costs of treatment.

In contrast, dental clinics with payment plans can serve patients like these and earn recurring revenue in the form of monthly payments. For instance, in this case, Emma pays $100 per month over the course of several months to cover her treatment costs.

In addition to this, Denefits provides protected payments, meaning that dental practices will receive the payment even if the patient fails to pay.

Therefore, dental practices can attract more patients like Emma, who might otherwise delay or forgo treatment due to financial concerns. This approach not only helps ensure patients receive the care they need but also allows practices to maintain a steady revenue stream by serving a wider clientele.

In essence, payment plans for dental treatments provide a practical solution for both patients and practices.

Why Are Dental Payment Plans the Need of the Hour?

Dental payment plans are becoming increasingly necessary, here are some key reasons why:

► Inherent Challenges of Traditional Financing

Not everyone qualifies for traditional dental care financing options like medical credit cards or personal loans, which require strong credit score and a solid payment history. For those with poor or fair credit score, approval rates are often low, and high interest rates—sometimes up to 26.99% APR—can significantly inflate the overall cost of dental care. This financial burden can lead patients, especially those living paycheck to paycheck, to delay or avoid treatment altogether, worsening their oral health.

Traditional dental care financing works better for large, one-time expenses but is less practical for smaller, recurring dental costs. In contrast, dental payment plans offer a more accessible solution, often with lower or no interest (for a specified period), helping patients manage costs more effectively.

► The Credit Score Factor

Many individuals have low credit scores, which often exclude them from traditional financing options. According to FICO statistics, 12.6% of Americans have poor credit scores (300-579), and 15.8% fall into the fair credit range (580-669). With credit scores in these ranges, securing favorable terms in dental financing, such as low-interest loans, becomes highly challenging. These individuals are often forced to pay higher rates or face outright denial of financing.

A Logical Solution

How Does Denefits Work?

Denefits dental payment plans have a no-credit-check policy, allowing patients with not-so-great credit scores to access affordable financing. By eliminating this barrier, payment plans enable them to receive care without overwhelming costs. They can divide the treatment expense into affordable monthly payments that fit their budget.

► The Insurance (Under) Coverage

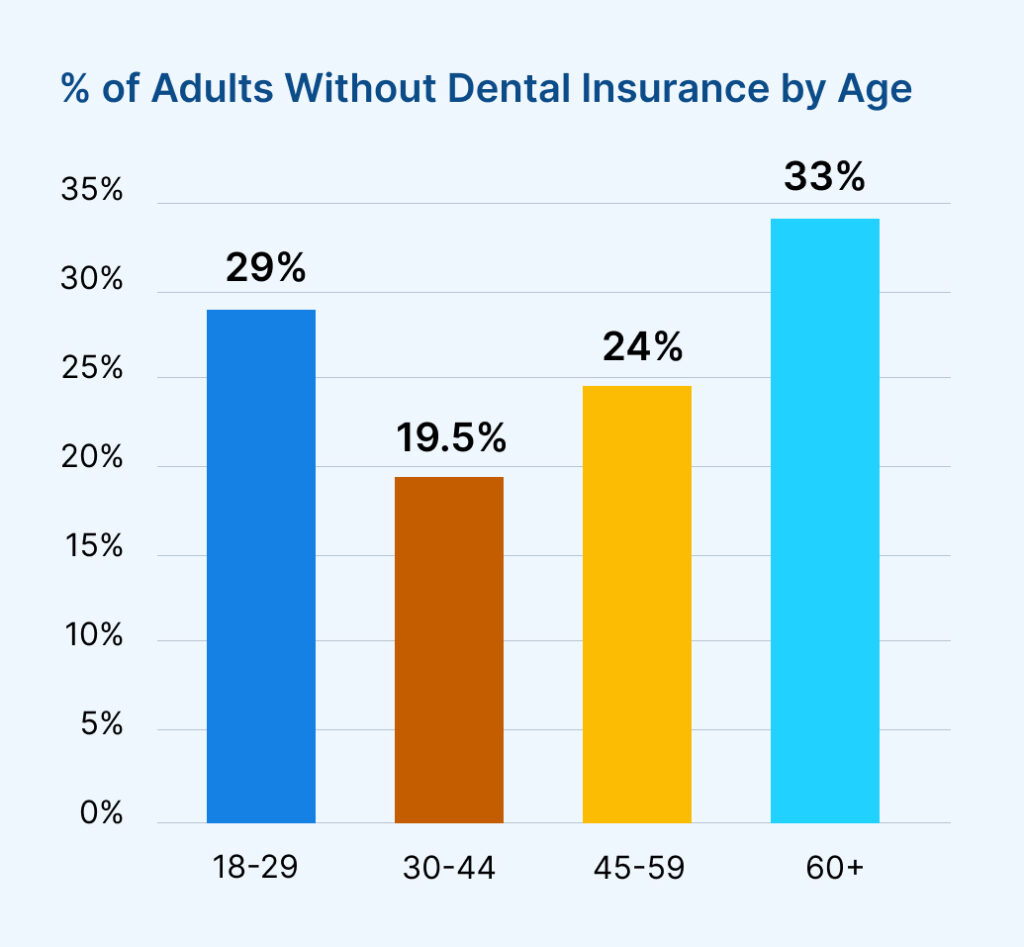

According to a 2023 survey by the CareQuest Institute, around 27% of the U.S. population—equating to 68.5 million adults—do not have dental insurance, making them less likely to visit a dentist regularly. Many of these individuals must cover the entire cost of their treatment out of pocket, leading them to avoid seeking care altogether. A deeper analysis also reveals the significant disparities in dental insurance coverage by age group.

Having dental payment plans can make treatments more affordable by breaking down costs, and giving uninsured individuals access to the care they need.

► The Price Point

How Much Does It Cost To Fix Your Teeth?

Here’s a table summarizing the average costs of common dental treatments in the U.S. Keep in mind that actual prices may vary depending on your location, dentist, extent of the treatment, and insurance coverage:

| Dental Treatments | Average Costs |

| Dental Implants | $3,000 - $4,500 |

| Dental Bridges | $2,000 - $5,000 |

| Dental Bonding | $90 - $1,000 |

| Dental Bone Graft | $400 - $1,200 |

| Dental Fillings | $200 - $600 | Dental Bleaching | $500 - $1,000 |

| Root Canals | $700 - $1,500 |

| Dental Crowns | $1,100 - $1,500 |

| Tooth Extraction | $75 - $300 |

| Replacement Options | $500 - $5,000 |

| Teeth Cleaning | $75 - $200 |

| Teeth Whitening | $500 - $1,000 |

The cost of dental treatment remains one of the biggest barriers to seeking care. According to the 2023 CareQuest Institute’s State of Oral Health Equity in America (SOHEA) survey, 9% of adults do not plan to visit a dentist for routine or preventive care in the coming year, with 45% citing cost as the reason. By offering flexible dentist payment plans, practices can help alleviate these concerns, making it easier for patients to access necessary treatments.

What Are the Benefits of Dental Payment Plans?

Dental payment plans offer a win-win solution for both dentists and patients. As stated above, by providing flexible payment options, dental practices can attract more patients, improve cash flow, and increase case acceptance rates. At the same time, patients benefit from affordable, manageable payments, making necessary treatments more accessible without the burden of large upfront costs.

Do Dentists Do Payment Plans?

Yes, many dental practices have partnered with Denefits to offer their patients flexible payment plans. They benefit from Denefits' 95% approval rate and no-credit-check policy to expand access to their services. Dental payment plans cover a range of procedures, from routine cleanings to more expensive treatments like dental implants or orthodontics.

Whether you're a patient looking for affordable care or a dentist seeking to expand your client base, explore the benefits of dental payment plans today!

Schedule A Demo

Conclusion

In conclusion, dental payment plans provide a practical solution for both patients and dental practices. For patients, these plans help plan their budget, making it easier to receive necessary treatments without delay. Meanwhile, dentists with payment plans can benefit from increased patient retention and a broader client base by offering flexible payment options.

In times when many individuals struggle with the high costs of healthcare, payment plans provide an essential bridge to ensure that oral health is not compromised due to financial limitations. Both patients and dental practices stand to gain from this mutually beneficial arrangement, ultimately improving access to dental care.

FAQs

1. Where Can I Get Payment Plans for Dental Work?

You can ask your local dentist if they offer payment plans. If they don’t, you can suggest they partner with Denefits, which provides no-credit-check financing options, helping patients manage treatment costs more easily.

2. What Are Some Dental Financing Options?

Dental financing options include payment plans, medical credit cards, and personal loans. While medical credit cards and loans typically depend on your credit score and may come with high interest rates, Denefits offer flexible payment plans without credit checks, making them accessible to more patients.

3. Where Can I Get Dental Financing With Bad Credit?

Denefits offer no-credit-check financing, making them accessible to patients with poor or bad credit.

4. Do Any Dentists Accept Payment Plans?

Yes, many dentists accept payment plans, either through in-house financing or third-party providers, to make treatments more affordable.

5. Where Can I Get Finance for Dental Implants?

Financing for dental implants is available through many dental practices or third-party companies like Denefits, which offer affordable, flexible payment plans. For more information on the cost of dental implants, check out our blog.

6. Where Can I Get No Credit Check Dental Financing Near Me?

Many dental practices offer no-credit-check financing through Denefits, which can help patients with bad credit get the care they need.

7. Do Dentists Have Payment Plans?

Yes, many dentists offer payment plans to help patients spread the cost of treatment over time. These plans are often interest-free (for a specified period) or have low interest.