Key Highlights

Chart Your Own Path

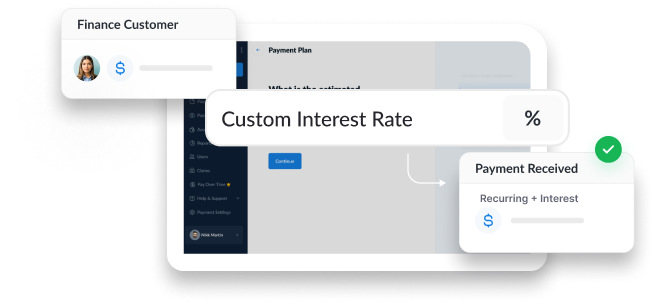

Denefits empowers businesses to establish their own terms and interest rates. This approach ensures that the pricing aligns with the business's financial goals while remaining competitive.

Increase Operational Efficiency

Denefits’ automated system handles everything from contract monitoring to sending payment reminders and reporting, while you focus on other crucial business operations.

Boost Sales

Attract more customers by offering them flexible payment plans tailored to their needs. Enjoy increased sales while earning interest at the rates you choose.

Strengthen Finances

By managing the financing process internally, you cut out middlemen, capture all potential revenue, and strengthen your financial control.

Encourage Repeat Business

Offering the convenience of paying at a pace that suits your customers’ financial circumstances makes them more likely to return for your services.

How Does Denefits In-House Financing Work?

Integrating Denefits offers a seamless way for businesses to provide financing options to customers. Here’s the step-by-step process:

Set Up Your Business Profile: Assess how Denefits aligns with your business goals and sign up to create your business profile.

Create Custom Payment Plans: Define the terms and conditions, including interest rates, repayment periods, and other terms to your liking.

Staff Training: Train your staff to address any issues or questions your customers may have about their financing plans.

Advantages

For Businesses

Seamless Integration - Integrate Denefits into your existing process. Simply put, at every customer interaction point, Denefits will ensure that your customers have direct access to financing.

95% Approval Rate - With a high approval rate, Denefits allows the majority of applicants to get instant access to your services.

Secure Transactions - Denefits follows the highest data standards and advanced encryptions to ensure all sensitive information stays protected.

Automated Management - Our automated system streamlines your workflow and reduces the administrative burden with efficient payment plan management.

For Customers

No Credit Check - Your customers enjoy easier access to services without the limitations of a credit check.

Instant Approval - With no-credit-check financing, it's easier for more of your customers to get instant approval.

Budget-Friendly Plans - With Denefits, customers can pay for services in easy monthly payments that fit their budget without a problem.

Multi-Language Support - Denefits supports over 10 languages, which helps businesses offer payment plans to customers in their preferred language. Hence, it benefits customers from diverse cultural backgrounds, breaking down language barriers.

What Makes Denefits the Ideal Choice for Your Business?

We understand the need to keep up with modern customers’ payment preferences while ensuring the financial needs of businesses are met. In-house financing by Denefits is a strategic tool to boost your business’s bottom line while aiding your customers with unparalleled flexibility in payments.