One in three adults — nearly 100 million Americans — struggle with unpaid medical bills.

Yes, medical debt is more common than you think. And it comes as no surprise given the steadily increasing cost of healthcare and the lack of insurance. The question is, "What happens if you don't pay hospital bills?" And the answers aren't exactly comforting. But don't worry, if you're someone who has ever encountered an unprecedented financial setback and wondered, "What happens if I don't pay my hospital bills?" or "How often do hospitals sue for unpaid bills?" read on.

Say Goodbye to Expensive Medical Bills

Explore Pragmatic Solutions for Handling Hefty Medical Bills with Our Healthcare Payment Plans.

| In this blog, we'll answer some of the questions those with medical debt are often perplexed by: ▶️What happens if I don't pay my medical bills? ▶️Is it illegal to send medical bills to collections? ▶️How often do hospitals sue for unpaid bills? |

First, let's look into the potential reasons behind growing medical debt, its repercussions, and ways to manage it.

The Anatomy of Medical Debt: Factors Contributing to Unsettled Bills

| Notably, Americans are estimated to collectively owe at least $140 billion in outstanding medical debt. |

Potential Reasons Being:

- Lack of coverage, leaves no room for individuals unable to meet high medical costs.

- Substantial out-of-pocket expenses, even with insurance, deter payment.

- Financial instability hinders the ability to pay for healthcare.

- Difficulty obtaining affordable insurance leads to increased medical expenses.

- Insufficient funds make it challenging to cover unexpected medical bills.

- Previous debt compounds the struggle to manage new medical expenses.

- Sudden medical emergencies result in hefty, unforeseen bills.

- Insufficient support programs leave gaps in coverage.

- Confusing procedures delay or prevent timely payments.

- Difficulty navigating the system impacts access to financial assistance.

- Lack of preventive care leads to severe health issues and higher costs.

- Fear of legal consequences deters seeking medical help.

- Limited access to healthcare facilities delays treatment and increases costs.

- Stigma prevents timely mental health treatment, escalating expenses.

- Lack of awareness about available resources hampers bill payment.

What Happens If You Don't Pay Medical Bills: The Ripple Effect of Repercussions

The consequences of unpaid medical bills extend beyond merely falling out of favor with healthcare providers. Yes, medical debt also hinders everyday Americans from securing loans and affording the essentials they need to get by. Let's understand the ripple effect triggered by unpaid hospital bills in various aspects.

| Financial Impact | Consequences |

|---|---|

| Debt Accumulation | Unpaid medical bills can lead to substantial debt, resulting in financial strain, overdue payment fees, and interest. |

| Credit Score Setback | Unpaid hospital bills may be reported to credit bureaus, making it challenging to obtain loans, credit cards, or secure housing. |

| Legal Consequences | Medical debt may be sent to collections agencies, leading to aggressive collection efforts and potential legal action. That’s not the end of it, creditors may pursue legal judgments, resulting in wage garnishment or asset seizure to settle the debt. |

| Healthcare Access | Outstanding medical debt may lead to limited future care, as some providers may refuse services or restrict access to non-emergency care. |

| Mental, Emotional and Social Well-being | Dealing with unpaid hospital bills, debt collectors, and legal action can contribute to stress, anxiety, and even depression. All of this combined with financial distress can strain relationships with friends and family. |

| Employment Concerns | Poor credit history from medical debt could affect job prospects, especially in industries or positions where employers conduct credit checks. |

| Housing Challenges | Landlords may conduct credit checks during the rental application process, impacting one’s ability to secure housing. |

| Bankruptcy Risk | As a last resort, individuals may consider filing for bankruptcy to manage medical debt. However, it has long-lasting repercussions on credit and financial standing. |

| Community and Social Impact | Financial difficulties from medical debt may lead to social isolation as individuals withdraw from social activities due to shame or embarrassment. |

Now that you know the potential reasons behind unpaid medical bills, and the repercussions that lead to it, let’s understand what happens if you don’t pay medical bills from a legal standpoint.

Is It Illegal To Send Medical Bills To Collections?

The answer to "Is it illegal to send medical bills to collections?" varies based on several factors, including local laws and regulations. More often than not, healthcare providers send medical bills to collections when patients fail to pay their bills within the decided time frame. That is unless you find a way to appease the issue before it escalates by finding a middle ground.

Nevertheless, many places have their own regulations and consumer protection laws that govern debt collection practices. What these laws do is stipulate certain procedures that debt collectors must follow and protect consumers from harassment or unfair practices. That said, understanding the laws applicable in your jurisdiction is crucial.

How Often Do Hospitals Sue For Unpaid Bills?

How likely and often hospitals pursue legal action for unpaid bills varies based on numerous factors. Moreover, it hinges on your prompt and proactive efforts to engage with the concerned hospital, seeking a middle ground before the matter gets out of hand. Nonetheless, let's take a look at various factors that might help you understand how often do hospitals sue for unpaid bills.

| Factors | Influence on Legal Action for Unpaid Bills |

|---|---|

| Hospital Policies | Varied policies may lead to differences in the pursuit of legal action. |

| Size and Type of Hospital | Larger institutions may have more resources for alternatives to legal action. |

| Financial Circumstances | Hospitals may consider a patient’s financial situation before pursuing legal measures. |

| State Laws and Regulations | Legal landscape and regulations regarding debt collection vary by state. |

| Contractual Agreements | Terms and conditions in agreements between the hospital and the patient can impact legal actions. |

And that should answer your question, "What happens if I don't pay my medical bills?" But what is the way out? How do you settle the unpaid bills and evade the repercussions? Don't worry, considering that you're not the only one with medical debt and this is a common issue, there are ways out of it. And even though managing unpaid medical bills isn't an easy affair and can be stressful, there are steps you can take to redeem yourself.

How To Make A Comeback After A Setback With Medical Debt

So you missed hospital bills, you can't spend the rest of your life repenting, however, it is imperative that you redeem yourself by taking the right steps.

Here are a few things to consider:

➡️Review your bills and insurance statements.

First things first, review all your medical bills and insurance statements to make certain there are no inaccuracies that need to be addressed. And that's not it, confirm that your insurance has been properly billed for covered services.

➡️Get in touch with your insurance company.

Is it even your fault? If you believe a claim was wrongly denied or notice any discrepancy, contact your insurance company for clarification. Keep all the necessary documentation to support your case handy.

➡️Proactively communicate with healthcare providers.

If you are unable to pay your medical bills due to an emergency or unprecedented circumstances, healthcare providers may give you the benefit of doubt, provided you proactively communicate. In turn, this could lead to the healthcare provider refraining from taking legal action and offering you the option to pay over time.

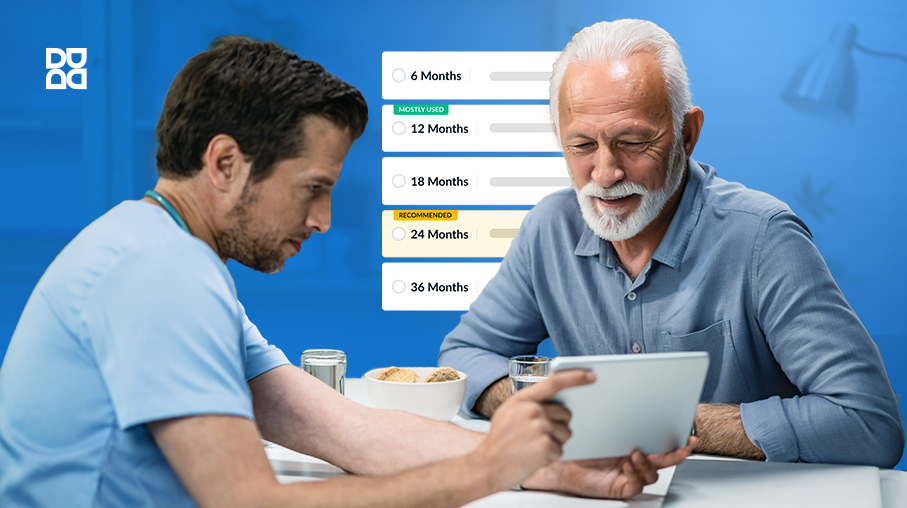

➡️Negotiate and set up a payment plan.

Given the challenges many Americans face in paying medical bills, healthcare providers have adopted ways to offer respite, such as payment plans. So, inquire with your healthcare provider about the possibility of setting up a payment plan to settle the bills.

➡️Seek Reprieve From Financial Assistance Programs.

Missing medical bill payments can be a consequence of financial hardships. And there are financial assistance programs or charity care options available to provide support in such situations. So, if you really are caught in a bind, don't hesitate to seek help from such organizations or resources.

➡️Pay Off Debts On Priority.

Most importantly, if you have multiple unpaid medical bills, prioritize them based on urgency and interest rates (if applicable). Focus on settling debts with the highest priority first, particularly those that are long overdue, as this approach helps prevent further escalation of the matter.

➡️Appeal for Government Aid.

And if you need the government to step in, don't be reluctant. Moreover, there are numerous government assistance programs you can seek reprieve from, provided that are eligible. For instance, some individuals may be eligible for retroactive Medicaid coverage for medical bills incurred within a certain timeframe.

How Payment Plan Solutions Like ‘Denefits’ Factor In

Bill Settlement Using Repayment Plans

Denefits enables healthcare providers to offer flexible and personalized repayment plans to patients with overdue bills. This allows patients to manage payments according to their financial capabilities and pay off their debt before their account incurs collections or legal action.

Healthcare Access For Individuals With Low Credit Scores

Denefits has a NO CREDIT CHECK Policy and a 95% approval rate, enabling access to healthcare services even for individuals with low credit scores. This ensures that financial constraints do not hinder their ability to receive necessary medical treatments or services.

Peace Of Mind Of Not Having to Pay In Lump Sum

Denefits provides a significant relief to patients by eliminating the need to pay medical bills in a lump sum. This approach not only promotes affordability but also encourages financial convenience, alleviating the stress typically associated with immediate and substantial payment obligations. That's not it, partnering with Denefits offers care providers a sense of peace, assuring them that the funds they are owed will be efficiently recovered.

Conclusion

The pervasive issue of unpaid medical bills affects millions of Americans, leading to severe consequences beyond healthcare. And What happens if you don't pay hospital bills? Well, legal actions, debt accumulation, and negative impacts on credit and well-being, to name a few . Naturally, addressing these bills promptly is crucial. And fortunately, there are ways to tackle unpaid medical bills, such as proactive communication with healthcare providers, seeking financial assistance, and settling bills with the help of Denefits' healthcare payment plans.

Frequently Asked Questions About Overdue Hospital Bills

1. Does Not Paying Medical Bills Affect Your Credit?

Yes, since unpaid medical bills are often reported to credit bureaus, they can lead to a drop in your credit score. This can negatively impact your creditworthiness.

2. What Is The Law On Unpaid Medical Bills In South Carolina?

Unpaid medical bills in South Carolina typically trigger collection actions and may result in legal consequences. However, the decision of whether providers opt to pursue legal measures depends on their discretion and choice to invoke such actions.

3. What Happens In America If You Can't Afford Healthcare?

It's no news that many individuals in America struggle to afford healthcare. However, this does not mean all hope is lost. Government assistance programs like Medicaid, insurance coverage, or the option to choose healthcare payment plans through Denefits enable individuals to access essential healthcare services despite the associated high costs.

4. What Is The Medical Debt Relief Act 2023?

The Medical Debt Relief Act was introduced on October 25, 2023, and is in the first stage of the legislative process. Mainly, the act aims to ban all medical debt from appearing on credit reports and to prohibit creditors from considering Americans' medical debt in their decisions on whether to extend credit.

5. Can You Ignore Medical Debt?

Unpaid medical bills can lead to collection efforts, legal actions, and damage to your credit score. That said, ignoring medical debt is not ideal.

6. Do Medical Bills Stay On Your Credit Forever?

No, medical bills do not stay on your credit forever; however, they do stay on your report for up to seven years, which is a considerable amount of time.

7. What Happens When Someone Does Not Have Health Insurance?

Without health insurance in the U.S., individuals may face higher out-of-pocket costs for medical services. They may also be subject to penalties for not having coverage, although enforcement may vary. Access to certain healthcare services may be limited.